Tobacco Control

There are many effective measures to reduce tobacco use that can lower smoking prevalence and prevent premature deaths.

Tobacco use is the largest preventable cancer risk factor. While global cigarette consumption and overall prevalence have been declining recently, success has been uneven. In countries with vigorous tobacco control policies, tobacco use has typically declined more.

In recent years, tobacco control proponents have developed a proven set of tools to address the challenges of tobacco use. These measures comprise the World Health Organization’s Framework Convention on Tobacco Control, which boasts more than 180 Parties. (Map 1) The treaty’s provisions include increasing tobacco excise taxes, creating smoke-free environments, and putting strict restrictions on tobacco product marketing and graphic warning labels on tobacco packaging.

Sugar, rum, and tobacco are commodities which are nowhere necessaries of life, which are become objects of almost universal consumption, and which are therefore extremely proper subjects of taxation.

Taxing tobacco aggressively has proven to be the most effective tobacco control measure. The mechanism is simple: governments put high excise taxes on tobacco products, tobacco companies raise prices to protect profits, and consumers react to higher prices by quitting, not initiating or reducing tobacco consumption. Importantly, young and/or lower-income people are more likely to be affected. (Figure 1) Through tobacco taxes, countries enjoy the benefits of lower consumption through higher productivity and lower healthcare costs, and tax revenues increase. Reinvesting these revenues in health can further enhance the effects.

Figure 1. Cigarette price and smoking prevalence in South Africa by income group.

As cigarette price increases from 4.2 Rand per pack in 1993 to 9 Rand per pack in 2003, smoking prevalence declined from 34% to 29% among high income people; from 33% to 23% among middle income people; and from 33% to 205 among low income people.

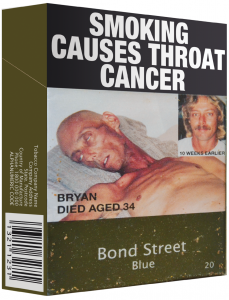

Graphic warning labels and plain packaging on tobacco products can counteract tobacco marketing efforts. In 2012, Australia moved beyond the gold standard of large, graphic warning labels on tobacco packaging by legislating plain standardized packages. Gone are the logos and color themes that even young children can identify around the world. (Map 2)

Tobacco firms’ success relies on their ability to present tobacco use as cool and glamorous. Most recently, firms have re-doubled their efforts to sell to young women and girls. To combat this, the health community must constantly remind people that smokers lose on average 11 years of life, and more than half of long-term smokers die prematurely from tobacco-attributable disease.

Finally, it is in countries where broad communities seeking improved social welfare— including health, human rights, and environment, among others—are speaking out loudly against tobacco that tobacco use is waning most.

ACCESS CREATES PROGRESS

Not only are tobacco taxes in the Philippines saving hundreds of thousands of lives, but the government is spending its new tobacco tax revenue on universal healthcare for low-income persons, improving health infrastructure, and helping tobacco farming communities.

Image:

Cigarette pack photo courtesy of Robert Eckford, Campaign for Tobacco-Free Kids.

Text:

Drope J, Schluger N, Cahn Z, et al. The Tobacco Atlas, 6th Edition. Atlanta: American Cancer Society and Vital Strategies, 2018.

Map 1:

Framework Convention Alliance. Parties to the WHO FCTC (ratifications and accessions). https://www.fctc.org/parties-ratifications-and-accessions-latest/

Map 2:

World Health Organization. 2018. Global Tobacco Control Report. Geneva: World Health Organization. Canadian Cancer Society. 2018.

Cigarette package Health Warnings: International Status Report. Toronto: Canadian Cancer Society.

Figure 1:

Van Walbeek CP. The Economics of Tobacco Control in South Africa. School of Economics, University of Cape Town; 2005.

Figure 2

Kaiser K, Bredenkamp C, Iglesias RM. 2016. Sin tax reform in the Philippines : transforming public finance, health, and governance for more inclusive development (English). Directions in development. Washington, D.C. : World Bank Group. Available from: http://documents.worldbank.org/curated/en/638391468480878595/Sin-tax-reform-in-the-Philippines-transforming-public-finance-health-andgovernance-for-more-inclusive-development